Form CMS-R-131 2008 free printable template

Show details

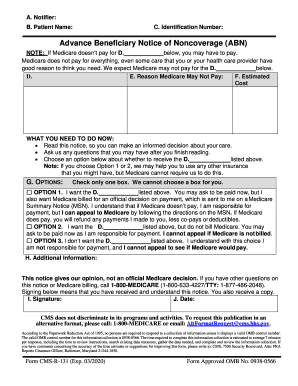

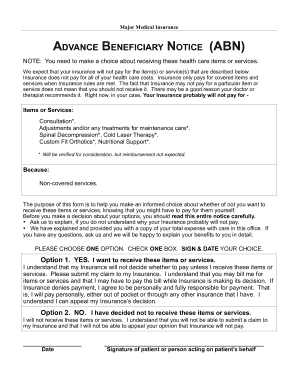

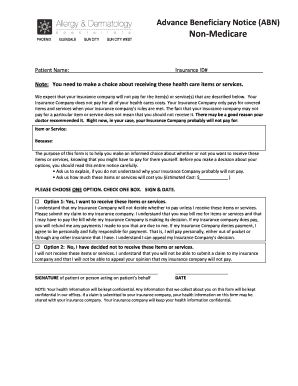

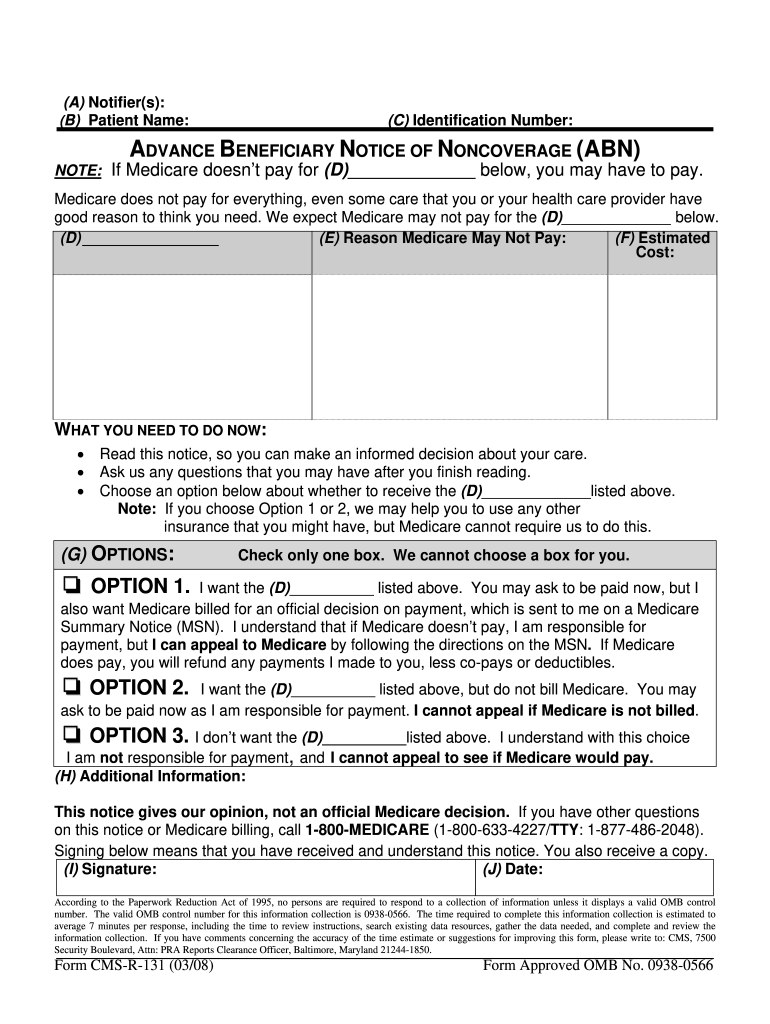

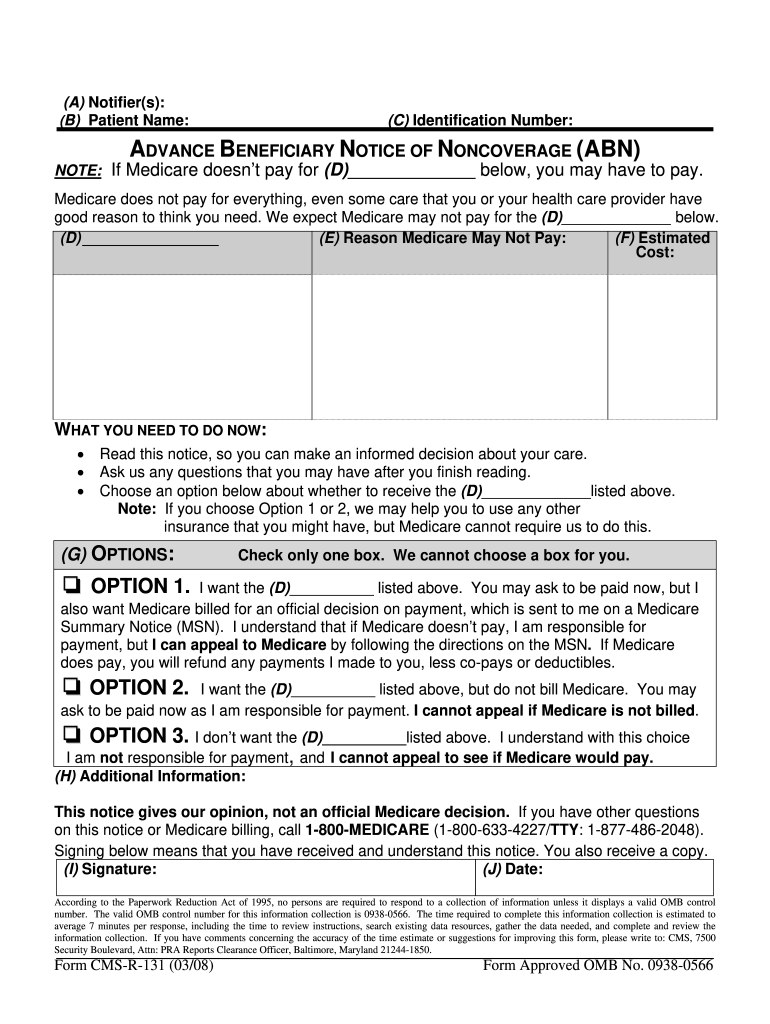

This version of the ABN continues to combine the general ABN ABN-G and the laboratory ABN ABN-L into a single notice with an identical OMB form number. Employees or subcontractors of the notifier may deliver the ABN. ABNs are never required in emergency or urgent care situations. Once all blanks are completed and the form is signed a copy is given to the beneficiary or representative. Instructions for completion of the form are set forth below. Once the new ABN approval process is completed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Form CMS-R-131

Edit your Form CMS-R-131 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Form CMS-R-131 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Form CMS-R-131 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Form CMS-R-131. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Form CMS-R-131 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Form CMS-R-131

How to fill out Form CMS-R-131

01

Obtain a copy of Form CMS-R-131 from the official CMS website or your local Medicare office.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated sections, including your name, address, and Medicare number.

04

Complete the sections that apply to your current situation regarding Medicare coverage.

05

Provide any additional information or documentation as required by the form.

06

Review your completed form to ensure all information is accurate.

07

Sign and date the form in the appropriate section.

08

Submit the form according to the instructions provided, whether by mail or electronically.

Who needs Form CMS-R-131?

01

Individuals applying for or updating their Medicare coverage or benefits.

02

People appealing a Medicare coverage decision.

03

Beneficiaries who need to report a change in their circumstances affecting their Medicare benefits.

Fill

form

: Try Risk Free

What is cms r 131 advance abn?

The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be ...

People Also Ask about

Who needs an ABN form?

An ABN is a written notice from Medicare (standard government form CMS-R-131), given to you before receiving certain items or services, notifying you: Medicare may deny payment for that specific procedure or treatment. You will be personally responsible for full payment if Medicare denies payment.

What is the ABN form used for?

An ABN form is a written notice that Medicare may not, or will not, pay for services or items recommended by your doctor, healthcare provider or supplier. The form includes the items or services that Medicare isn't expected to pay for, the reasons why and an estimate of the costs.

What is an ABN form and who needs one?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

Who uses ABN Form Medicare A or B?

Therefore, an ABN is used for services rendered to Original Medicare FFS (Part A and Part B) enrollees. That means an ABN is not required for Medicare Part C and Part D.

Who must receive the ABN form?

The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be

What is an ABN form and under what circumstances should one be given to a Medicare patient?

An Advance Beneficiary Notice (ABN), also known as a waiver of liability, is a notice a provider should give you before you receive a service if, based on Medicare coverage rules, your provider has reason to believe Medicare will not pay for the service.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Form CMS-R-131 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your Form CMS-R-131 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the Form CMS-R-131 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your Form CMS-R-131 in seconds.

How do I edit Form CMS-R-131 on an Android device?

You can make any changes to PDF files, like Form CMS-R-131, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Form CMS-R-131?

Form CMS-R-131 is a form used by the Centers for Medicare & Medicaid Services (CMS) to collect information necessary for the proper administration of Medicare benefits and programs.

Who is required to file Form CMS-R-131?

Individuals or entities that provide information related to Medicare services and benefits, including healthcare providers and suppliers, are required to file Form CMS-R-131.

How to fill out Form CMS-R-131?

To fill out Form CMS-R-131, users need to carefully read the instructions provided on the form, complete all required sections with accurate information, and submit the form as per the guidelines given by CMS.

What is the purpose of Form CMS-R-131?

The purpose of Form CMS-R-131 is to ensure that CMS collects adequate data to manage Medicare programs effectively and to make informed decisions regarding healthcare services and reimbursements.

What information must be reported on Form CMS-R-131?

Form CMS-R-131 requires reporting of specific information related to healthcare services provided, patient demographics, treatment details, and any other relevant data as mandated by CMS.

Fill out your Form CMS-R-131 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form CMS-R-131 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.